Brexit Changes: British tourists can now claim back up to 20% VAT on their purchase in EU

Travelling to Europe After Brexit?

One of the great things about post-Brexit travelling in Europe is that British travellers can now claim a VAT refund on purchases made in the EU! This includes popular holiday destinations like France, Italy and Spain etc. After all this time, we can finally benefit from tax-free shopping (who ever knew this even existed?)

What is tax-free shopping?

Goods in European countries, like in the UK, contain VAT (value-added tax). This tax is automatically added onto your shopping and can be as much as 20-25% of the net price. However, if you're shopping abroad and take your purchases home with you to enjoy, you can get a refund on the tax that you've paid. Think of it as duty-free shopping at airports, except now you can do it in the city in most stores too.

Photo by Tim Douglas from Pexels

A quick VAT lesson

It's important to bear in mind that the VAT is added to the net price to arrive at the final, gross price of a good. Taking France, where VAT is 20%, as an example, here's how the breakdown of VAT would look like:

Example: Purchase price (€1000) = Product original price (€833.33) + VAT (€166.67)

So even though VAT is 20% in this case, it's in fact 16.67% of the gross price. A mental shortcut I like to use is to divide the gross price by 6 to arrive at VAT. Top tip from the VAT pros – now you know!

So how much can you actually expect to save when shopping tax free? There's no "do-it-yourself" when it comes to VAT refunds, so you'll always have to go through a VAT operator. How much your take-home refund comes to is based on the service fee charged by your VAT-refund provider, calculated as a % of VAT. The fee range varies across a large range and comes down to the VAT refund operator. Typically, once all fees are deducted, you can expect to get somewhere between 6% - 15% of the ticket price back, with an average of about 8%.

Who and what is eligible for tax-free shopping?

If you reside in England, Scotland or Wales and visit Europe for less than 6 months, we have some good news for you – you can claim a VAT refund on your purchases! However, there are rules around what you can and cannot claim. Goods which are not used or consumed on your trip will qualify – think fashion items, cosmetics, jewellery, technology and yes your wine too. On the other hand, restaurant bills, metro tickets, gas bills or alcohol you've already drunk will not qualify. If you're planning to stay in the EU for a bit longer, also make sure you keep an eye on your purchase time, as the right to claim a VAT refund expires at the end of 3 months after the date of your purchase. For example, if you are leaving in April (anytime between 1st - 30th April), the earliest date you can make a purchase and reclaim VAT on it is 1st January.

We know VAT is never sexy, but throw the word "shopping" in, and everything changes. The fashionistas amongst you are probably rubbing your hands in glee already. But even if you're not a particularly huge shopper, it's still a big thing to know that you can buy things 6% - 15% cheaper just across the channel. Who knows, maybe you'll also win some impressed nods at your next pub quiz by showing off your tax refund knowledge...

About Wevat App:

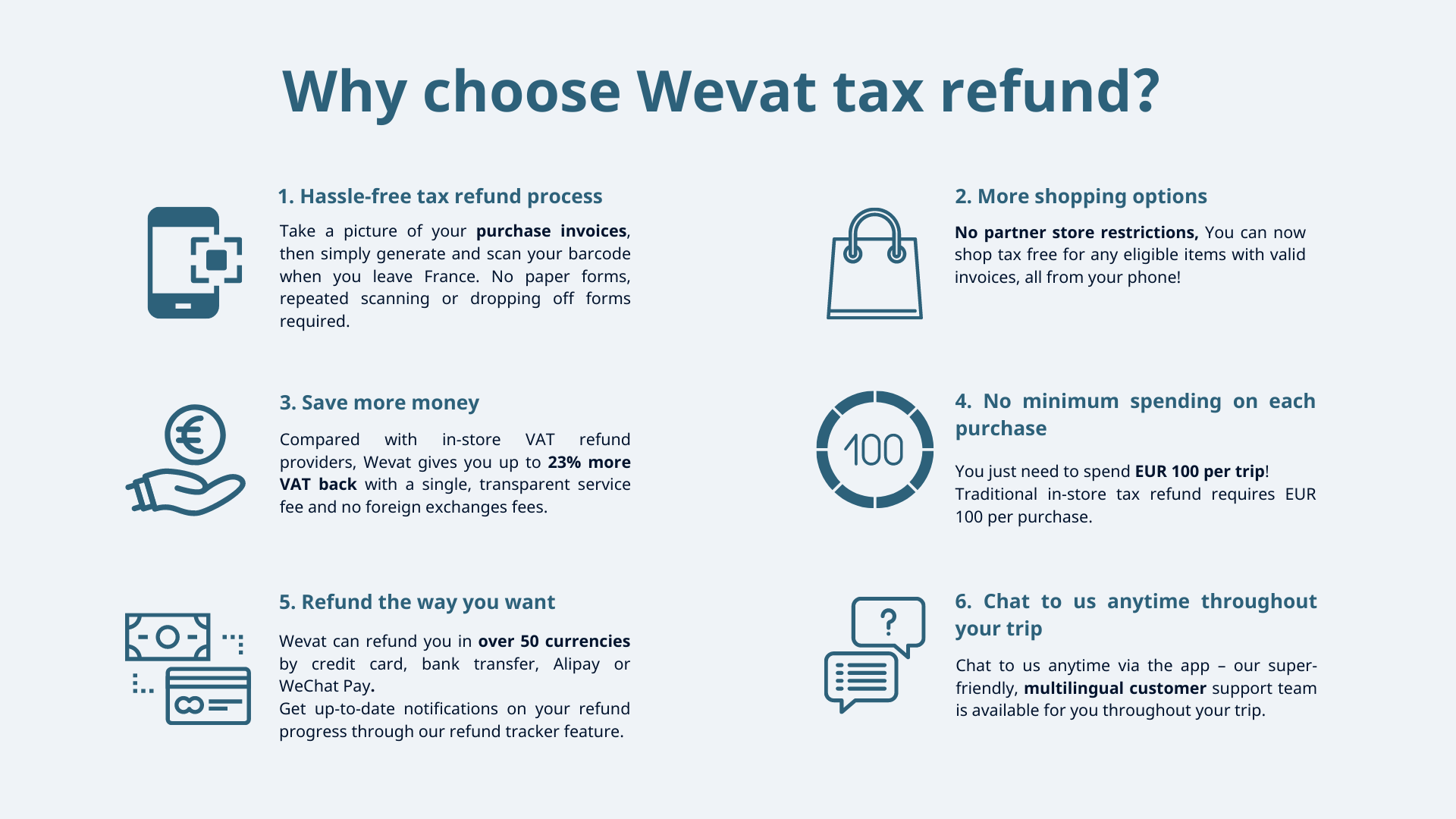

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.