Tax-free shopping in France: How to claim VAT refunds if leaving France for Switzerland

Travellers from outside the EU may be entitled to a Value Added Tax (VAT) refund on the goods purchased during the trip to EU countries such as France. Normally, you’ll need to get your VAT refund approved at your departure airport/ train station/ ferry port before leaving the last EU country. However, if you're headed to Switzerland after your time in France, how to claim your tax refund may differ a lot.

In this blog post, we'll provide a complete guide on how to get a tax refund when leaving France for Switzerland. By following these steps, you can successfully claim your refund and have a little extra money to spend on your travels to Switzerland.

A recap on tax refunds

There are two main steps to getting a VAT refund on shopping in France:

Get a refund form

Validate your refund form

Getting a refund form

There are two main ways you can get a tax refund form – using the traditional, in-store paper method, or a digital app like Wevat.

Using the traditional method, you’ll need to show your passport to the sales assistant, ask for a refund form, and do some form filling every time you buy something.

With a digital app like Wevat, you don’t need to do any of that – our app combines invoices together into a single digital refund form, accessible at any time on your phone.

Another perk of using an app is that you get more money back compared with the in-store method, and can track your refund in real-time, so you never have to worry about losing your refund.

You’ll also find that many shops, especially high-street boutiques and small shops, are not set up to offer a VAT refund to tourists. This is where Wevat comes in handy – the app works even for purchases made at shops not set up to issue a refund form. Instead of asking for a refund form, you only need to ask for an invoice (”facture”) instead. Check out our comparison of digital vs. traditional in-store tax refunds for more information.

Another huge advantage is that there is no minimum spend per purchase. Traditionally, you had to spend €100 per transaction to qualify for a VAT refund, but with Wevat, you’re eligible as long as you spend a total of over €100 across all your purchases.

You may end up with a combination of paper and digital forms depending on the stores you use, and that is totally fine. Where you can, you might want to use the Wevat app to process your ‘factures’ into a digital refund form, which will save you time and money overall.

France tax free shopping App Wevat

Validating your refund form

Whichever method you choose, you will need to validate your refund form.

At many departure points in France – you can now make use of electronic “détaxe” kiosks (referred to as “PABLO” kiosks) to easily scan and validate your forms in a matter of minutes. Where this is not available, you will need to find the local customs office by following the “détaxe” signs and have a printed, paper version of your refund form physically stamped in order for it to be validated.

Wevat saves you the hassle and faff of needing to keep (and not lose!) your paper refund forms, instead aggregating all your purchases into a single barcode that can be accessed at any time on your phone.

So to save us all from the stress of confusion of validating a refund form, we’ve summarised the key steps if you enter Switzerland when departing from France by different means or arrive at different arrival points.

Détaxe/ Tax Refund

Before heading to the departure point:

To avoid having your VAT refund claim rejected, do this well in advance of heading to your departure point.

If you’re using Wevat:

Upload your invoices onto the app 12 hours before your train or flight so they can be verified in time. We recommend adding your invoices as you shop. If you are shopping last minute, that’s also fine – just let us know using in-app chat so we can accelerate the verification for you

6 hours before your flight or train, generate your refund form in-app and check all the information is correct

If you’re using the traditional in-store method:

Make sure you’ve asked for a refund form at every shop you made a purchase at. The receipt itself does not qualify for a tax refund!

Have all the receipts of your purchased goods and tax refund paper forms issued from shops prepared

Process of getting your VAT refund if leaving France for Switzerland:

1.Flying from France to Switzerland

Many of the French airports have ‘PABLO’ self-service tax refund kiosks, you can simply get your VAT refund using the ‘PABLO’ kiosk for easy processing before departing. We have blogs about where and how to do your tax refunds when departing from Charles de Gaulle, Orly airports and Nice Côte d'Azur Airport.

If you’re arriving at Geneva Airport and your French departure airports don’t have PABLO self-service tax refund kiosks, you can also get your refund form validated after your flight arrives at Geneva Airport. This is because Geneva Airport is shared by Switzerland and France, which has the French sector and the Swiss sector. You can go to the French sector (not the Swiss sector) of Geneva Airport after getting off the plane and scan your refund form using the ‘PABLO’ Détaxe kiosk. Simply follow the Détaxe sign, then you’ll see it, or ask for staff’s help at the airport if having a problem finding it.

Geneva Airport

Geneva Airport

2. Travelling from France to Switzerland by train

If you taking a train from Paris to Switzerland, the main transportation you will use is the TGV, which departs in Paris at Gare de l’Est or Gare de Lyon. There are no “Détaxe” PABLO kiosks available at the station in Paris, so you may need to get off the train at the border and find PABLO Détaxe kiosks or the French customs office to get your refund form validated.

Some railway stations that have PABLO Detaxe kiosks:

Gare de Genève Cornavin, 1201 Genève (Suisse)

Gare SNCF Bourg Saint Maurice, 73700 Bourg Saint maurice

Gare SNCF Moutiers Salins Brides les Bains, 73600 Moutiers

TGV train

French customs office

Détaxe PABLO kiosks

3. Driving from France to Switzerland

If you drive from France to Genève, Switzerland, there’re PABLO kiosks located at the French-Swiss border, which address is 1218 Grand-Saconnex, Switzerland. You can take the bus to get there by getting off at the station Grand Saconnex, Douane 01210 Ferney-Voltaire. Please make sure it’s from the French customs side, not the Swiss customs side.

There’re some other PABLO kiosks which can be found at the French-Swiss border where you can get you (e)refund forms scan and go:

Plateforme autoroutière Vallard-Thonex, A411, 74240 Gaillard

Plateforme douanière autoroute Saint Louis, 68300 Saint Louis Hall d’accueil

Brigade des douanes de la Ferrière, 25370 La Ferrière-Sous-Jougne Poste frontière La Ferrière-sous-Jougne

Grand Saconnex, Douane

French customs side

How to get your tax refund form approved?

Once you get to the self-service kiosks, just follow the self-explanatory on-screen instructions if you’re using Wevat:

Select your language

Scan the barcode on your digital form in the Wevat app

Wait for customs approval (a green screen will appear with the message "Validated Form"). We also recommend that you take a picture of the screen for your records. All that's left to do is wait to receive your refund via your preferred refund method. If you want to track your refund, just refer to the in-app tracker or contact the customer support team via live chat.

If you have any traditional paper tax refund forms, scan the barcodes one by one as above. These validated paper forms will then need to be mailed to the designated refund mailbox (most often located on the customs desk near the PABLO machine) with the original receipts. Then you will receive your refund back the method you chose when you issue the tax refund forms in the shop. You can email a traditional tax refund company if you want to check its status.

Select language - tax refund kiosk

Form validated - tax refund kiosk

Validated form number - tax refund kiosk

What if a red screen appears?

Don’t worry, this is normal.

Occasionally, French customs will want to manually check your passport and purchases, possibly even your invoices and receipts. If you see this screen, follow the instructions to go to the customs counter which is usually very close to the PABLO “détaxe” kiosks, and they will complete the process for you.

Terminal not in service - tax refund kiosk

About Wevat

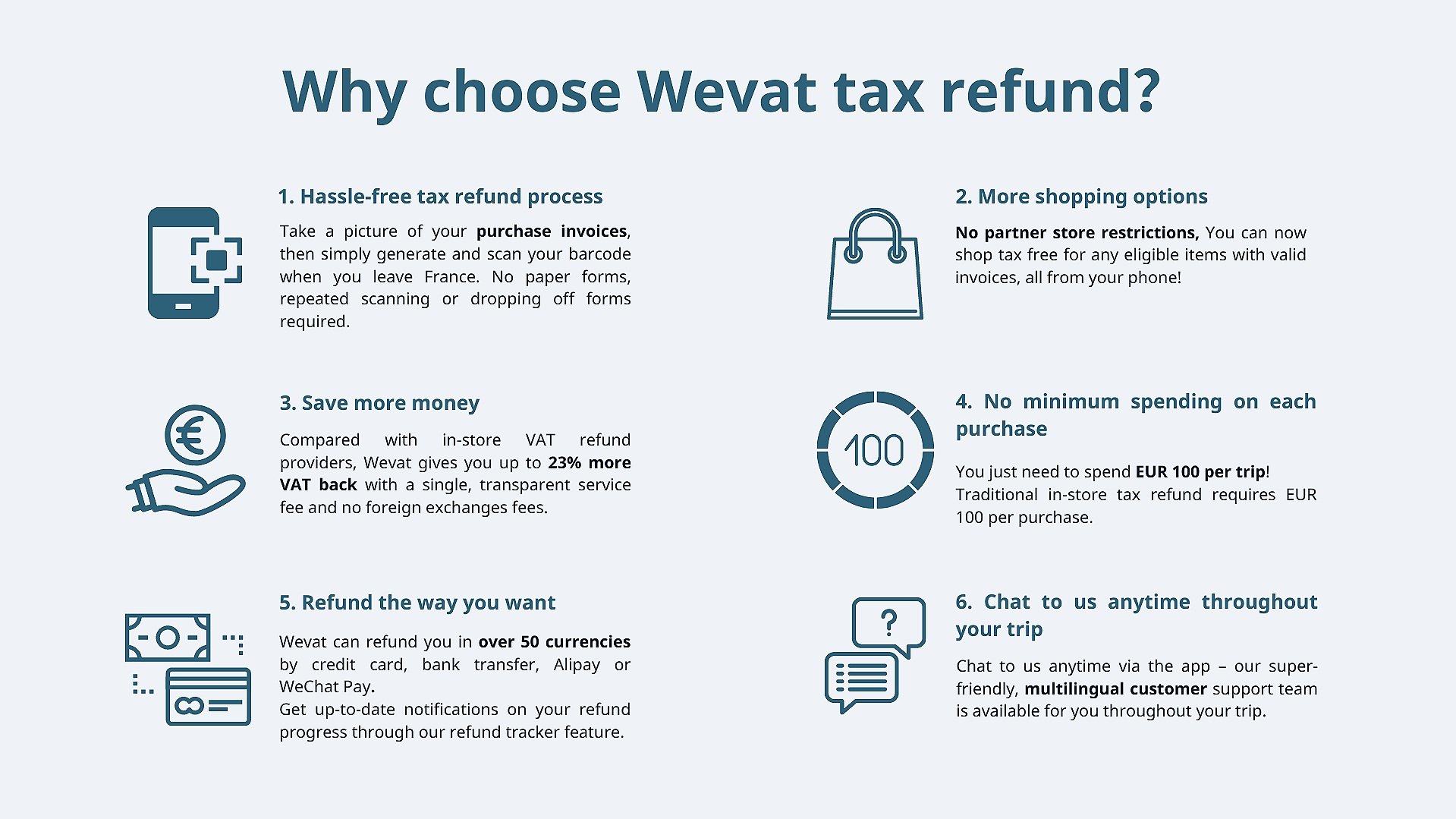

Wevat is a digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love traveling, shopping, and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping.

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices and then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning, or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.