Tax-free Shopping in France: How to Choose the Best VAT Refund App or Service

Shopping in France can be even more rewarding when you take advantage of VAT refunds. As an international tourist, you can reclaim some of the tax paid on your purchases, turning your spending into significant savings. However, with various VAT refund options available, finding the best fit can be a bit overwhelming.

This guide will walk you through the essentials of tax-free shopping in France and help you choose the most suitable VAT refund app or service for a seamless shopping experience.

VAT refund sign

A Brief Guide to Tax-free Shopping in France

What Is VAT Refund?

VAT (Value Added Tax) is a tax added to the price of goods and services in many European countries, including France. This tax can be as high as 20-25% of the net price of an item. The good news? If you're a non-EU tourist, you can reclaim this tax on items you take home, turning your shopping spree into a tax-free experience! Imagine getting a rebate on your purchases as if you were at a duty-free shop at the airport, but in the heart of Paris or any other French city.

How Much VAT Can You Really Save?

There's no "do-it-yourself" when it comes to VAT refunds, so you'll always have to go through a VAT operator. The amount you get back depends on the fees charged by your VAT refund provider. Typically, once all fees are deducted, you might see around 6% - 15% of the total purchase price, with an average of about 10%. The more efficient the tax refund app or service you choose, the better your savings.

Who Can Claim a VAT Refunds in France?

To qualify for a VAT refund in France, you need to meet a few criteria:

Have your permanent address outside the EU;

Be visiting the EU for less than six months; and

Be departing the EU for a non-EU country with your purchase within 3 months following the month in which you bought your item

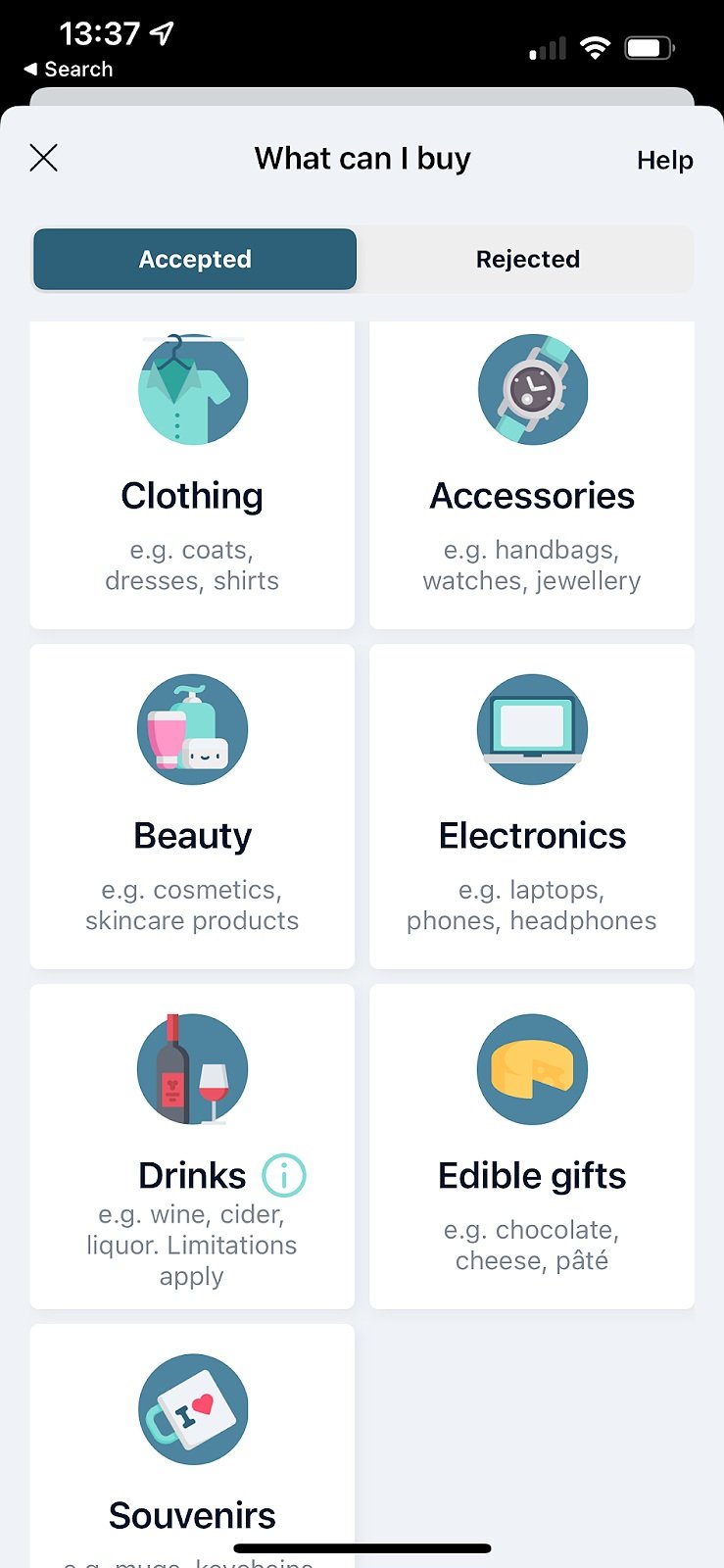

You can reclaim the tax on most of your shopping — thinking clothing, bags, jewellery, watches, electronics, beauty and pharmacy products, even fine wines! As a general rule, things you’ll use on your trips like tickets and food are excluded.

Items you can claim VAT back on

Main VAT Refunds Methods in France

When shopping tax-free in France, you’ve got two paths: the traditional method and the digital method.

Traditional VAT Refund Method

Traditional tax refund methods involve using paper forms provided by tax refund companies like Global Blue or Planet. To use this method, the store where you shop must be partnered with one of these companies, usually indicated by a tax refund sticker in the shop. After you make your purchase, you’ll fill out the forms in-store.

While this method is straightforward and well-established, keep in mind that the store will take a cut from your refund, meaning you might receive less money back. And don’t be surprised if some of the smaller, local shops don’t offer this option at all.

Digital VAT Refund Method

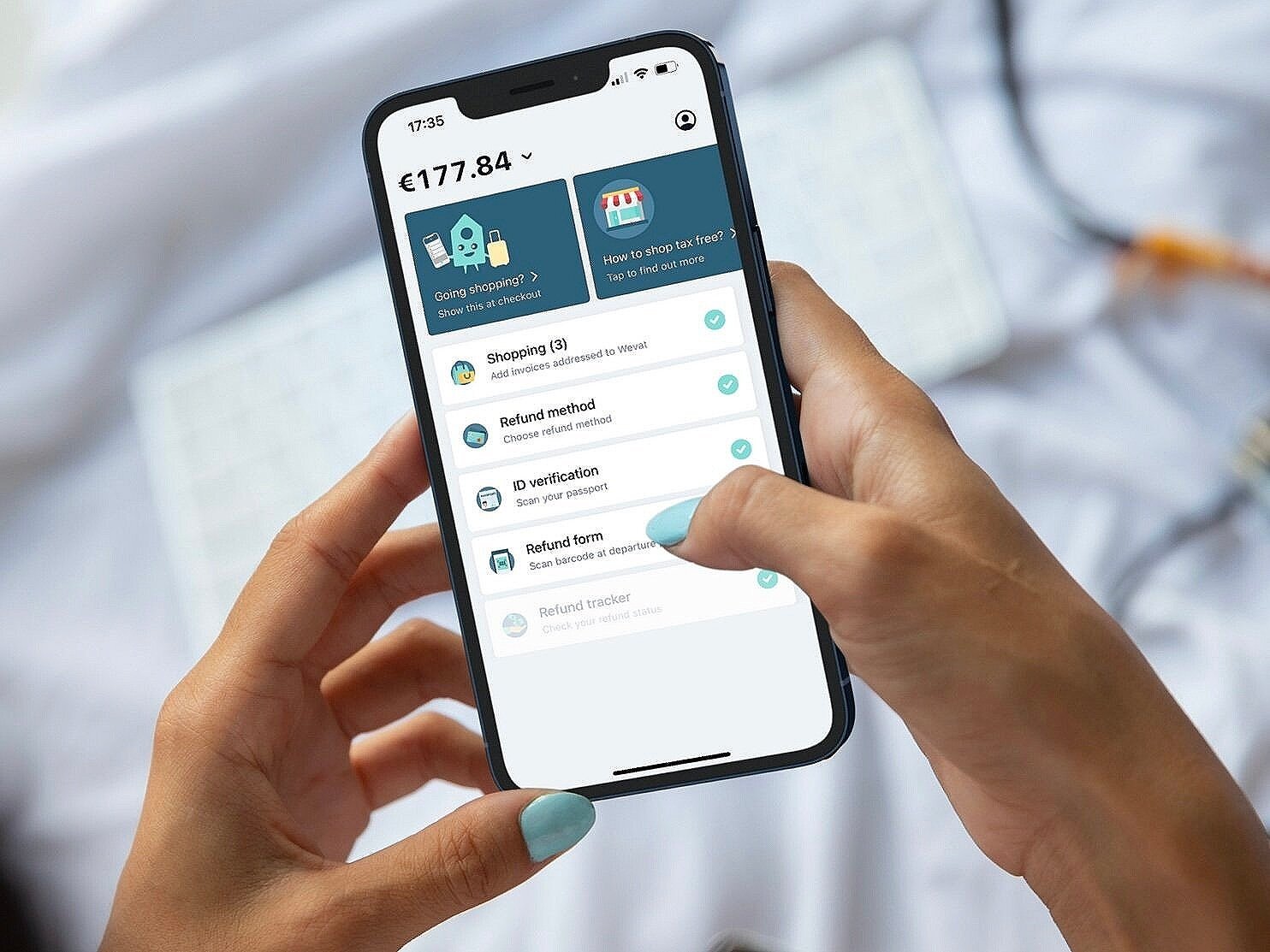

Digital tax refund methods are becoming increasingly popular due to their ease and efficiency. Instead of fiddling with paper forms, you just snap a photo of your purchase invoice and let an app like Wevat handle the rest. Upload the invoice to the app, and your digital refund form is ready. When you’re heading home, just scan the app’s barcode at a self-service tax refund kiosk, and you're good to go.

What’s more, you get more refund since there’s no middleman taking a cut, and you won’t need to deal with paper forms. Just be aware that some store staff might not be familiar with the digital refund method or might push the traditional option, so obtaining an invoice from certain stores, like luxury brands such as Louis Vuitton, might require some extra communication.

Wevat tax refund digital app

Key Factors to Consider When Choosing a VAT Refund App or Service

When selecting the right VAT refund provider for your tax-free shopping in France, here are some key factors to consider:

1. Legal Licensing

One of the first things to look out for is to make sure the tax refund company is legit and trustworthy, since they'll handle your real money! With plentiful options out there, both traditional and digital, it's crucial to choose one that's licensed, legit, and playing by the rules. The best way to ensure that is to stick to providers authorised and regulated by French customs. Always double-check from here that the company is on the official list of licensed tax refund operators in France.

2. Tax Refund Rate

VAT refund providers offer different rates and fees, which can vary based on their service charges and whether shops take a cut from your refund. To get the best bang for your buck, it’s worth comparing these rates.

Traditional tax refund services, which are partnered with shops, typically provide a refund rate of 10%-12% of the purchase price. In contrast, some digital tax refund apps like Wevat, which operate on a B2C business model, give you up to 13% in refunds. Please also be aware that choosing instant cash refunds may reduce the rate to 8%.

3. Purchase Threshold

To qualify for a VAT refund in France, the French tax authorities require that each refund form meets a minimum spend of over €100, whether you're using paper forms or digital services.

Here's where it gets interesting — since the Wevat tax refund app will combine all your purchase invoices into a single digital tax refund form, there's no minimum spend required per purchase; instead, you just need to spend over €100 in total across the entire trip in France. However, traditional VAT refund methods typically require you to spend more than €100 on each individual purchase to qualify for a VAT refund.

Traditional tax refund sticker

4. Store Restrictions

Some VAT refund operators have restrictions on the partners or stores you can shop at. As mentioned, traditional tax refund methods only work with specific shops, so you can only claim your tax back on those shops. Digital VAT refund apps like Wevat offer more flexibility, as you can reclaim VAT from a broader range of shops — such as charming local boutiques or everyday pharmacies — as long as you obtain an invoice at checkout.

5. Efficiency and Convenience

Efficiency in the VAT refund process involves various factors, for example, how easily to get a tax refund form or purchase invoice, and how quickly to get your (e)tax refund forms verified. For traditional methods, popular stores often have staff who are pros at handling those paper forms, making the process smooth and straightforward. On the other hand, digital tax refund apps are newer, and some store staff might not be as familiar with them, but asking for a facture (“invoice” in French) and showing the app screen can usually work well.

No matter which method you choose, you’ll need to have your purchases verified before leaving France or the EU. If you’re at an airport, train station, or ferry port with self-service tax refund kiosks, using a digital app can be a breeze — just scan the barcode on your digital form and be on your way! Otherwise, remember to scan each of your paper forms. Alternatively, if there are no kiosks, ask a customs officer to scan your paper forms or print your digital form for scanning. Here’s a list of French departure points equipped with tax refund kiosks to help you plan ahead.

Self-service tax refund kiosks

6. Transparency in Fees and Processes

When choosing a VAT refund provider, it’s crucial to select one known for transparency in fees, processes, and refund timelines. If you want a clear picture of your spending, the VAT you’ll get back, and the service fees involved, a digital app like Wevat is your best bet. Traditional methods may involve hidden costs or variable exchange rates, leaving you surprised when receiving the refund.

Plus, Wevat has a live refund tracker that details each step of the VAT refund process, from verification to payment initiation, which ensures you’re always informed and reassured, so you can simply wait for your refund to come through without any uncertainties.

7. Refund Processing Time

When it comes to getting your VAT refund, waiting can be a drag. Traditional tax refund methods generally take between 3 to 12 weeks to process your refund. Wevat, however, offers flexible options to suit different needs. You get the 3-to-12-week timeline with a more competitive refund rate of up to 13%!

If you need your funds more urgently, Wevat also provides a fast refund option. For a slightly higher service fee, you can get your money within just one week of your departure. Choose the option that best fits your needs.

8. Customer Support

Exceptional customer service is key to a smooth VAT refund experience, especially if you encounter any issues or have questions during or after your trip. Wevat stands out in this regard with its friendly and bilingual support team. The responsive customer service is designed to guide you through every step of the refund process, ensuring that any concerns are promptly addressed.

To wrap it up — we hope our detailed guide helps you to make an informed choice, enjoy a hassle-free shopping experience, and get more VAT back in your pocket. Happy shopping and enjoy your tax-free savings in France!

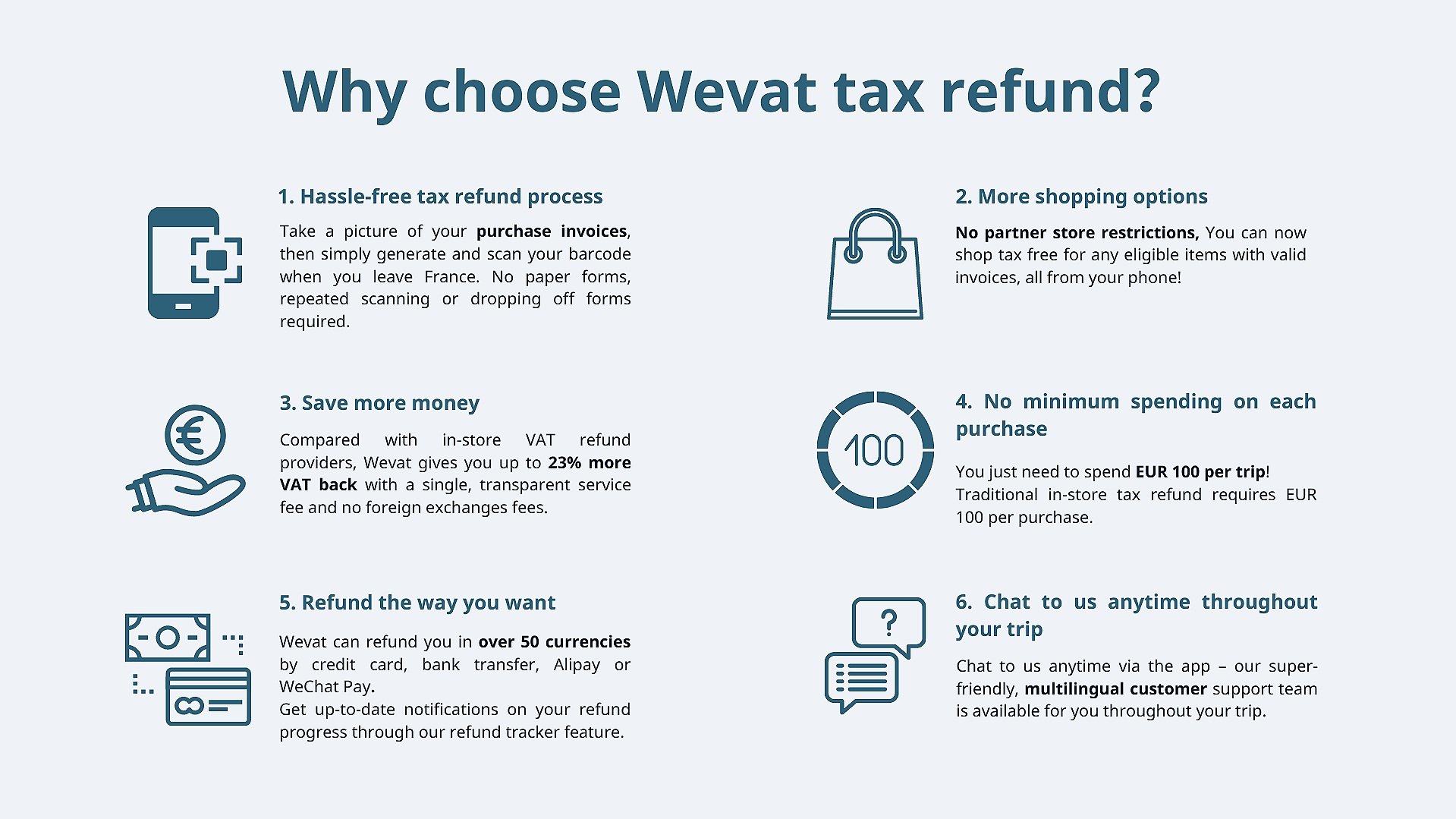

About Wevat App

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.