Complete guide to tax-free shopping in France for Brits-save up to 20% VAT on your shopping!

Travelling to France?

Are you planning on travelling to France soon? Then do not miss this article about tax-free shopping and how you can save you up to 20%VAT back on you shopping during your trip. One of the great things about post-Brexit travelling in Europe is that British travellers can now claim a VAT refund on purchases made in the EU! This includes popular holiday destinations like France, Italy and Spain etc. After all this time, we can finally benefit from tax-free shopping - who ever knew this even existed?!

What is tax-free shopping?

Goods in European countries, like in the UK, contain VAT (value added tax). This tax is automatically added onto your shopping, and can be as much as 20-25% of the net price. However, if you're shopping abroad and take your purchases home with you to enjoy, you can get a refund on the tax that you've paid. Think of it as duty-free shopping at airports, except now you can do on the shopping high street in your favourite European cities!

How much can I save from tax-free shopping?

It's important to bear in mind that the VAT is added to the net price which adds together to make the final, gross price of a good. In France, where VAT is 20%, as an example, here's how the breakdown of VAT would look like:

Example: Purchase price (€1000) = Product original price (€833.33) + VAT (€166.67)

So even though VAT is 20% in this case, it's in fact 16.67% of the gross price.

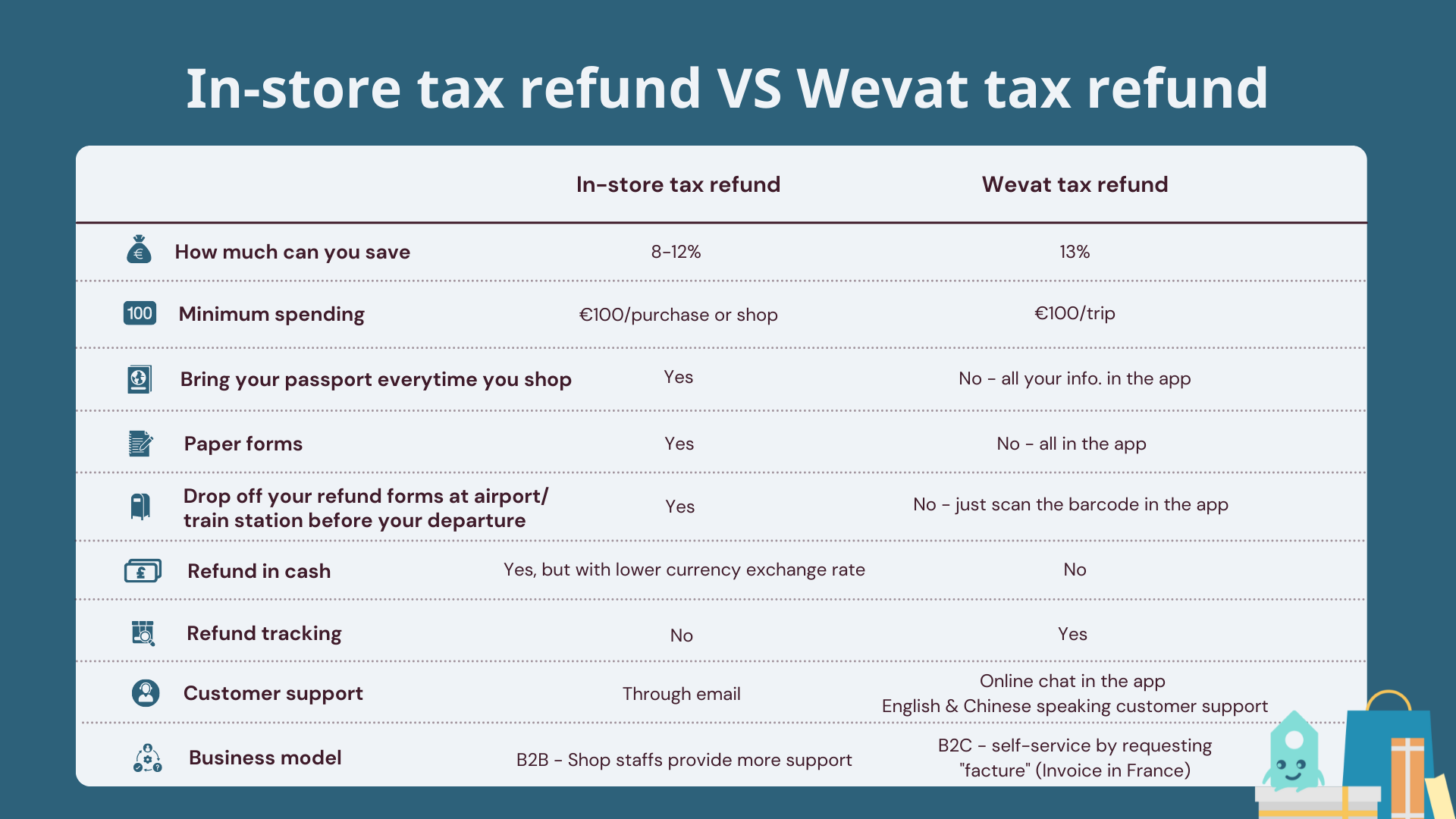

So how much can you actually expect to save when shopping tax free? There's no "do-it-yourself" when it comes to VAT refunds, so you'll always have to go through a VAT operator. How much your take-home refund comes to is based on the service fee charged by your VAT-refund provider, calculated as a % of VAT. This fee varies across a large range, and is independently set by the VAT refund operator. Typically, once all fees are deducted, you can expect to get somewhere between 6% - 15% of the ticket price back, with an average of about 8%.

Am I eligible to claim tax refund in France?

If you are a non-EU resident, the answer is YES. One of the great things about post-Brexit travelling in Europe is that British travellers can now claim a VAT refund on purchases made in the EU!

How do I get my VAT-refund?

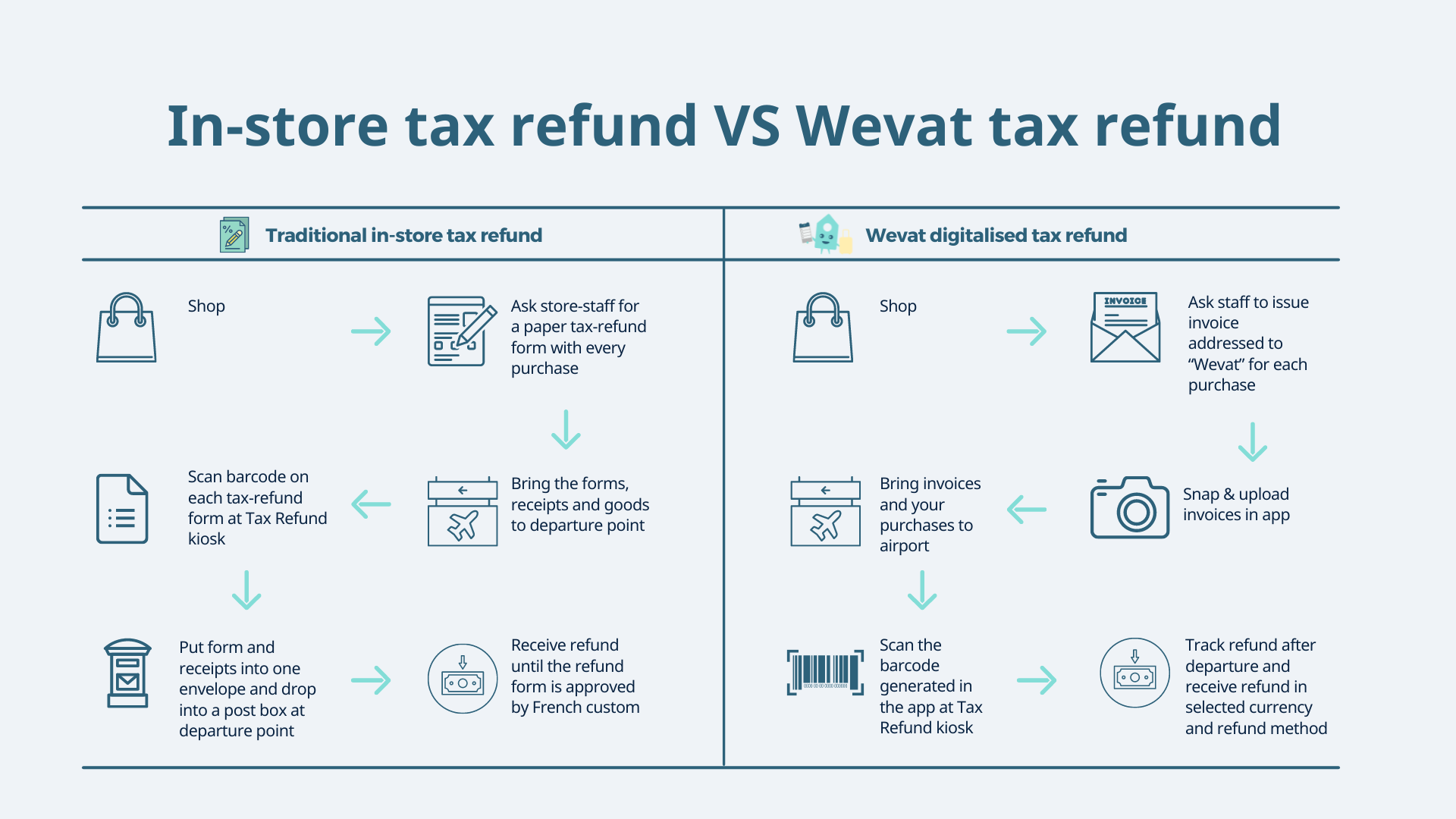

There are two main methods you can get refunded:

The traditional paper tax refund form method - requires a minimum of 100 EUR per store transaction.

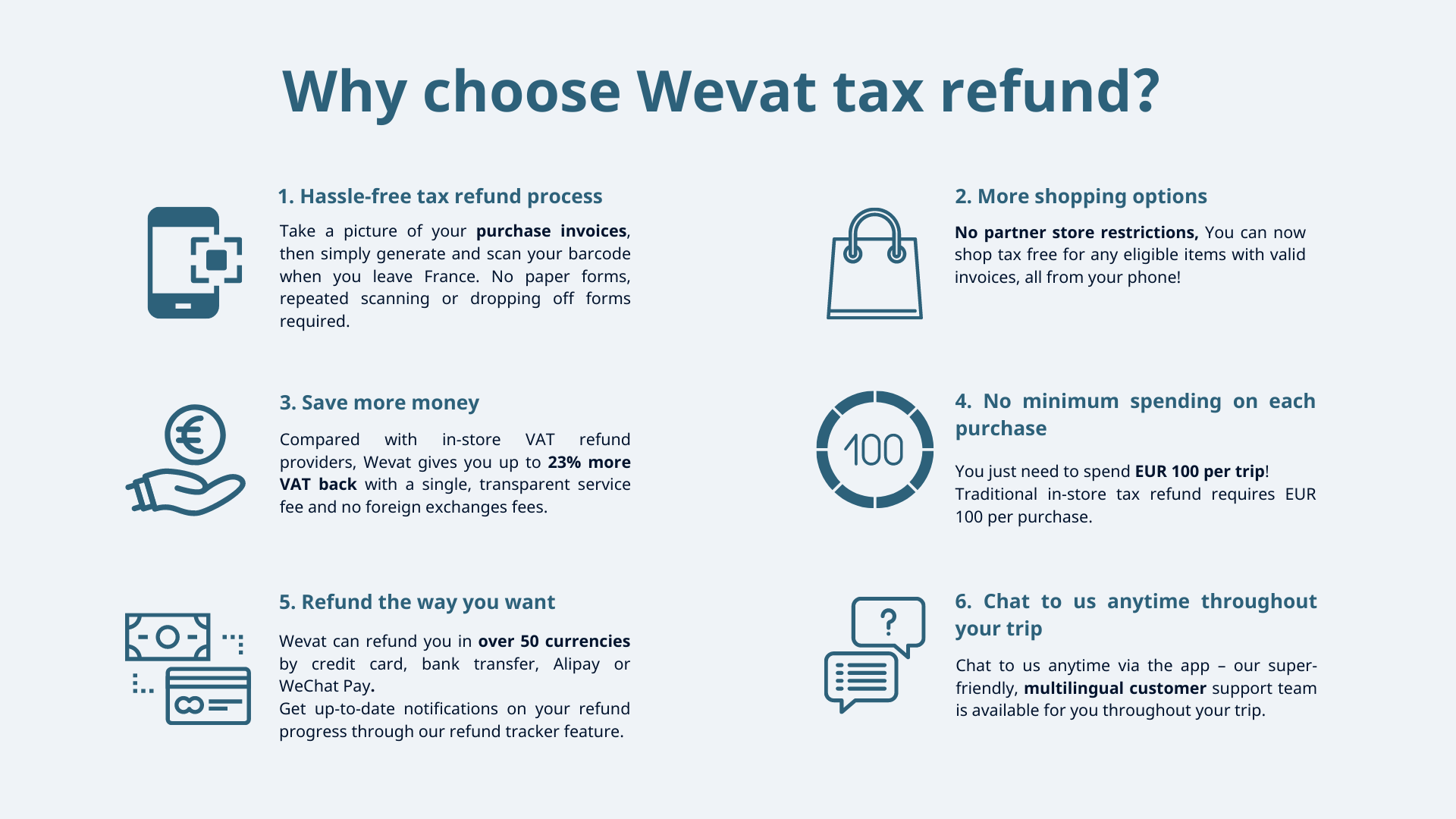

A digital refund app (such as Wevat) - requires a total spend of 100 EUR across the whole trip. Plus, with Wevat the rate of refund is a little higher than traditional players so you’ll be getting more money back!

About Wevat App

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Start Your Journey Now - Get Access to Wevat France!

Wevat app is finally here and available for you to download on the App store or Google Play!

Please download before purchase to validate shopping.