How to get your VAT-refund in Paris Charles de Gaulle (CDG) Airport, France?

So, you’ve recently discovered the joys of tax-free shopping in France - congratulations! How does it feel knowing you can save hundreds of euros on your tax-free shopping just by using Wevat? (Pretty good we imagine!).

If you are travelling back home via Paris Charles de Gaulle Airport you may feel a little daunted with the next stage in the refund process. But don’t panic...we’re here to help with this visual step by step guide (check out our other guide if you are travelling via Eurostar Gare du Nord.)

Charles de Gaulle Airport

What you need to know before heading to Paris Charles de Gaulle Airport?

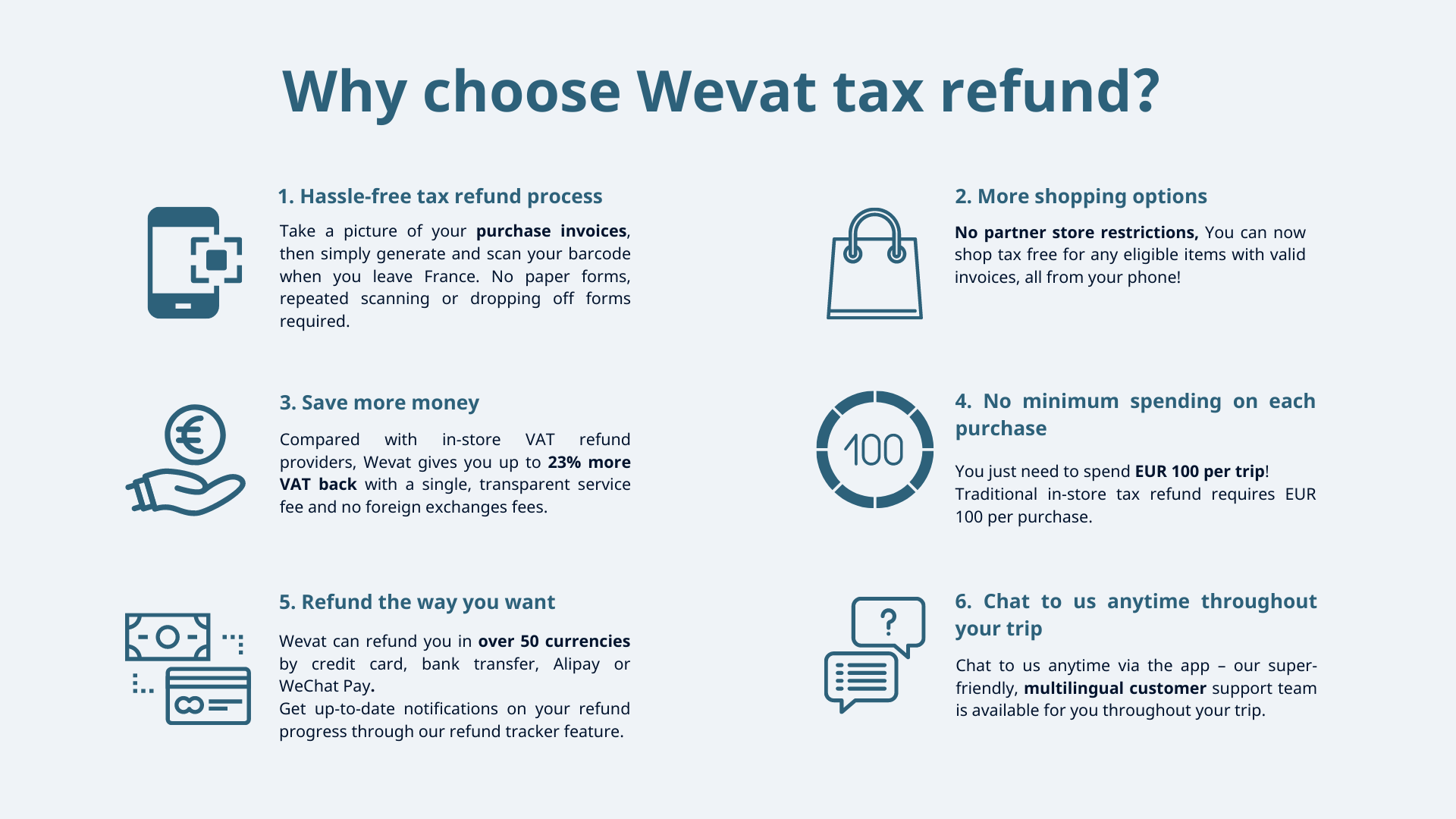

There are two main ways you can get a tax-refund - using a traditional in-store paper method, or a digital app like Wevat. The main perk of using a digitalised method with Wevat is you get 23% more money back compared with the in-store method. Another benefit is you only have to spend a total of €100 across all your purchases rather than €100 per store. We have a complete guide of digital tax refund vs traditional in-store method here for your reference.

You may end up with a combination of paper and digital tax refund methods depending on the stores you use, if you’re not sure which shops you can shop at, visit our other article which explains where you can use Wevat.

Whichever method you choose, you will need to go to the station/airport to get your (e)refund form validated at customs before you leave the EU.

Before travelling to the airport for your departure flight:

There are a few steps you need to take before your departure flight to avoid claim rejections.

If you use Wevat for tax refund, upload your invoices in-app 24 hours if possible before your flight so they can be verified in time. We recommend processing your invoices as you shop

Generate your refund form in-app and check it's right

Have your invoices and shopping together as French Customs may ask to see these at the airport, so make sure they're packed somewhere accessible like your hand luggage for now

Once you arrive at the Paris Charles de Gaulle airport, head to the Détaxe area in your departure terminal BEFORE checking in:

Step 1 - Find the PABLO détaxe Tax refund self-service kiosks located in your terminal:

You will find these signposted as ‘Détaxe / Tax Refund’ located at:

Terminal 1: CDGVAL level, Hall 6

Terminal 2A: Departures level, Gate 5

Terminal 2C: Departures level, Gate 4

Terminal 2E: Departures level, Gates 3/4

Terminal 2F: Arrivals level,

Terminal 3: Departures level, international customs zone

Terminal 2A: Departures level, Gate 5

Terminal 2C: Departures level, Gate 4

Terminal 2E: Departures level, Gates 3/4

Terminal 2F: Arrivals level

Step 2 - Follow the Tax refund kiosks on-screen instructions to get your tax refund approved:

Select your language

Scan the barcode on your digital form in the Wevat app.

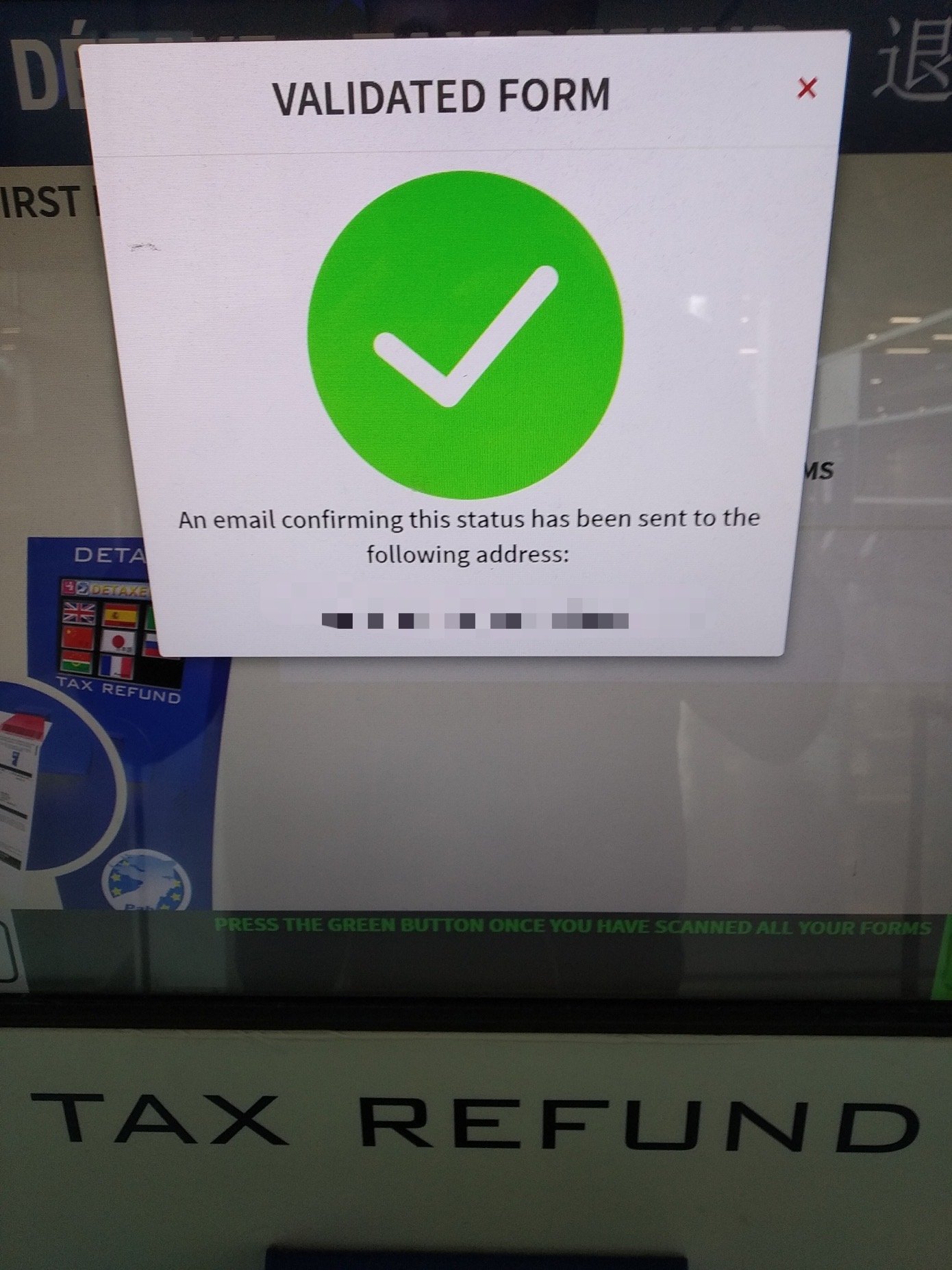

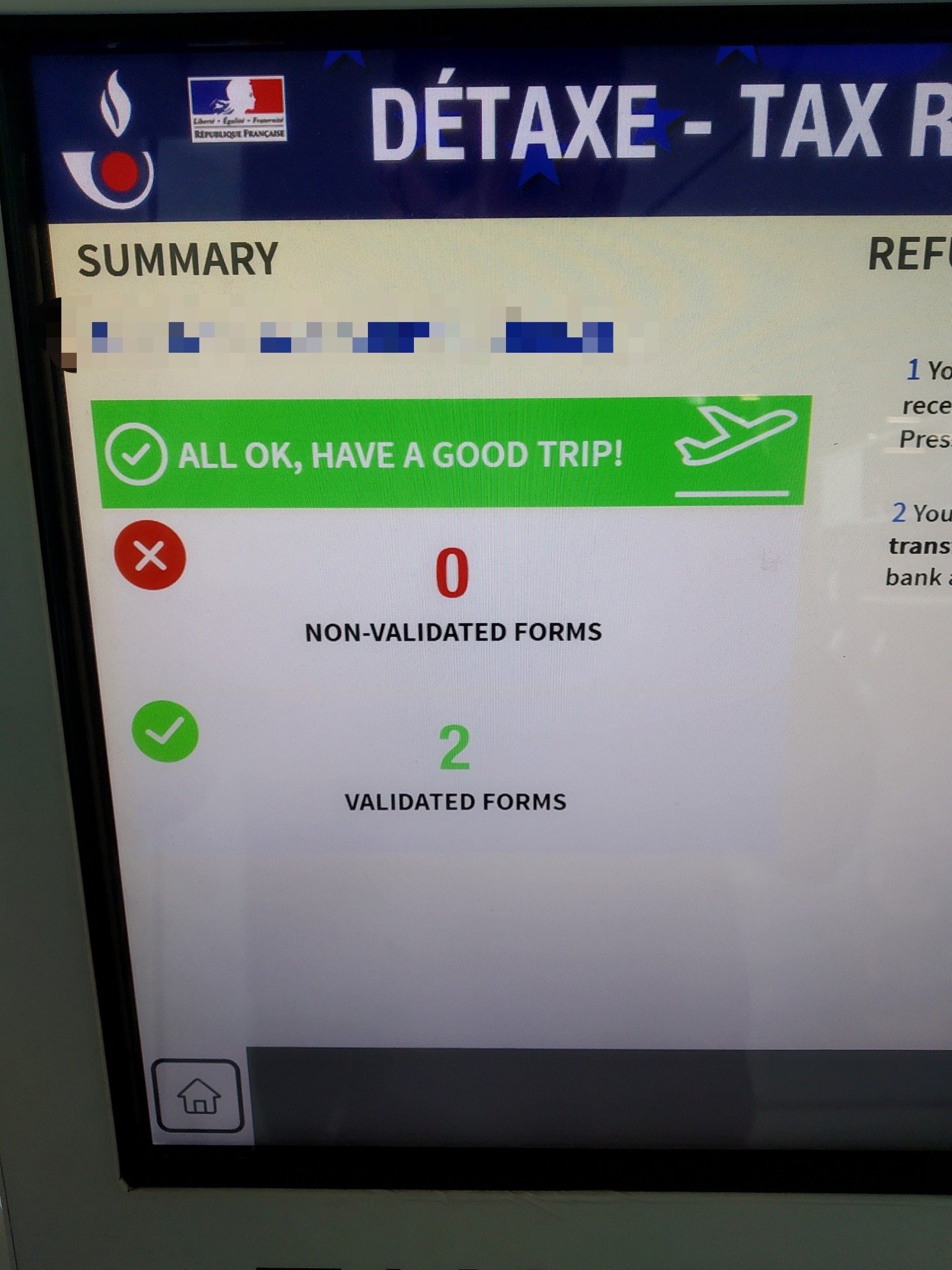

Wait for the customs approval (a green screen will appear with the message "Validated Form"). We also recommend that you take a picture of the screen for your records. You will also get a notification from the Wevat app once your form is valid.

If you have any traditional paper tax refund forms, scan the barcodes one by one as above. These validated paper forms will then need to be mailed into the designated refund mail box with the original receipts (most often located on the customs desk near to the tax refund kiosk).

If you encounter any issues with the self-service machines (i.e. barcode not scanning, or an error screen), seek assistance at a manned customs desk nearby.

Please note: You may be asked to show your shopping, invoices and receipts to the French Customs agents, so make sure they are easily accessible. This is why we recommend doing your tax refund before checking in your baggage (in case the Customs officer needs to see the items you have purchased). Once you have completed the tax refund you can pack your items away in your checked luggage if necessary.

Select language-tax refund kiosk

Form validated-tax refund kiosk

Validated form number-tax refund kiosk

Step 3 – Head off to your check in desk to continue your journey back home

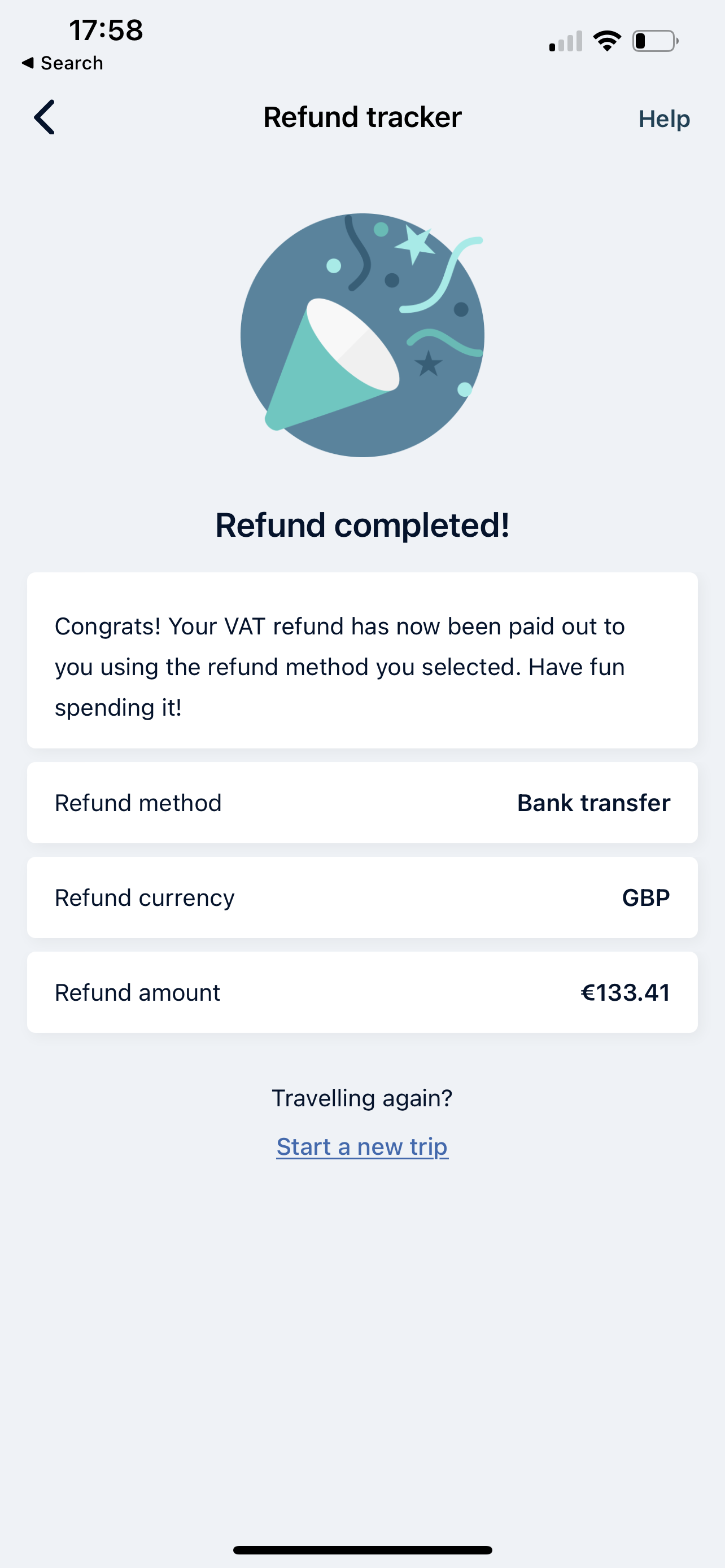

Once you have completed the tax refund process, you can head off to your airline check in desk, continue onto security and finally relax at your boarding gate before your flight home. You can also check the refund tracking status in the Wevat app the next day. If you have any questions, just use the live chat in the app. For the traditional method, if you don’t hear back after one month, go to the tax refund provider’s website and send them an email.

And that’s all there is to it! Seems less daunting now, doesn’t it? If you’re using Wevat, your refund should arrive shortly so all that’s left to do is relax with your new purchases and maybe plan the next shopping trip with those savings!

Refund tracker-wevat app

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.