Good news! Online purchases are now accepted for tax refunds on Wevat

This summer we are providing a limited-time service for tax refunds on online purchases, for all eligible tourists traveling to France. Here’s what you need to know before shopping and a guide to how to get a tax refund for online shopping step by step.

What you need to know before shopping:

Ensure you are shopping at a French-registered retailer.

The retailer must be VAT registered and is addressed in France - look for a “VAT” or “TVA” number starting with “FR”. We suggest you check with the retailer before you shop.

(Check the registered address from T&Cs on the retailer website to ensure it is incorporated in France)

It must be delivered to an address in France. Click and collect at a shop in France also works.

Ensure you are eligible to use Wevat and shop goods that are eligible for a tax refund. Check our FAQ page to learn more.

How to get a tax refund for online shopping?

Step 1: Sign up to Wevat and check your eligibility

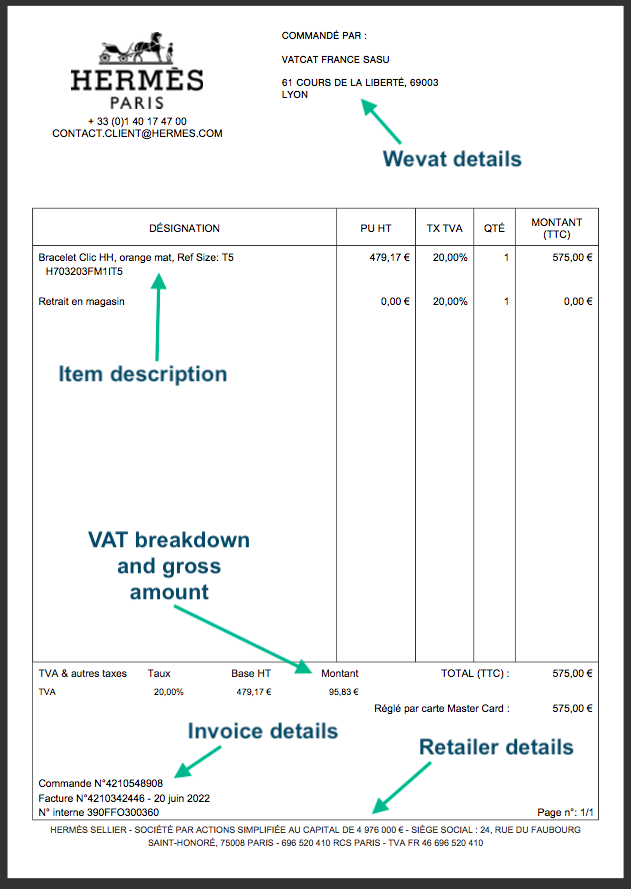

Step 2: Shop online and obtain an invoice addressed to Wevat by entering the following details under the billing address section:

Company name / First and last name: Vatcat France

Address: 61 Cours de la Liberté, 69003 Lyon

When you process your online order, in the payments section you can usually add the above address in the “company” part. If that option is not available, you can insert “Vatcat” as a first name and “France” as a last name:

Entering Wevat details under the billing address section

or you can ask their customer support team to issue one for you. (Important note: Please make sure you have entered our address as the billing address and not use the delivery address, as the retailer may end up delivering your items to our office.)

Step 3: Once you have received or collected your goods, please forward your invoice to e-invoices@wevat.com, in the subject, insert the email address that is linked to your Wevat account.

Once Wevat has verified it you will see it show up in the app within a few hours. (Please note, we cannot accept order confirmation emails or pro-forma’s).

Hermes e-invoice

Amazon.fr e-invoice

Step 4: Scan your in-app barcode at your departure point

Ensure you bring all the goods you purchased online and offline goods (if it applies) when you depart, incase Customs ask to inspect them

Step 5: Receive your refund

Your refund will be confirmed 2 days after your departure and be paid within 3 months

Updated on 1st July 2022