Why tourists can enjoy tax-free shopping in France?

In most countries, the price of goods will include value-added tax (VAT), which is automatically added to your shopping, and can be as much as 20-25% of the original price 😱.

Luckily, if you're shopping abroad and take your purchases home with you to enjoy, you're eligible for a VAT refund. Think of it as duty-free shopping at airports, except now you can do it in the city in most stores too.

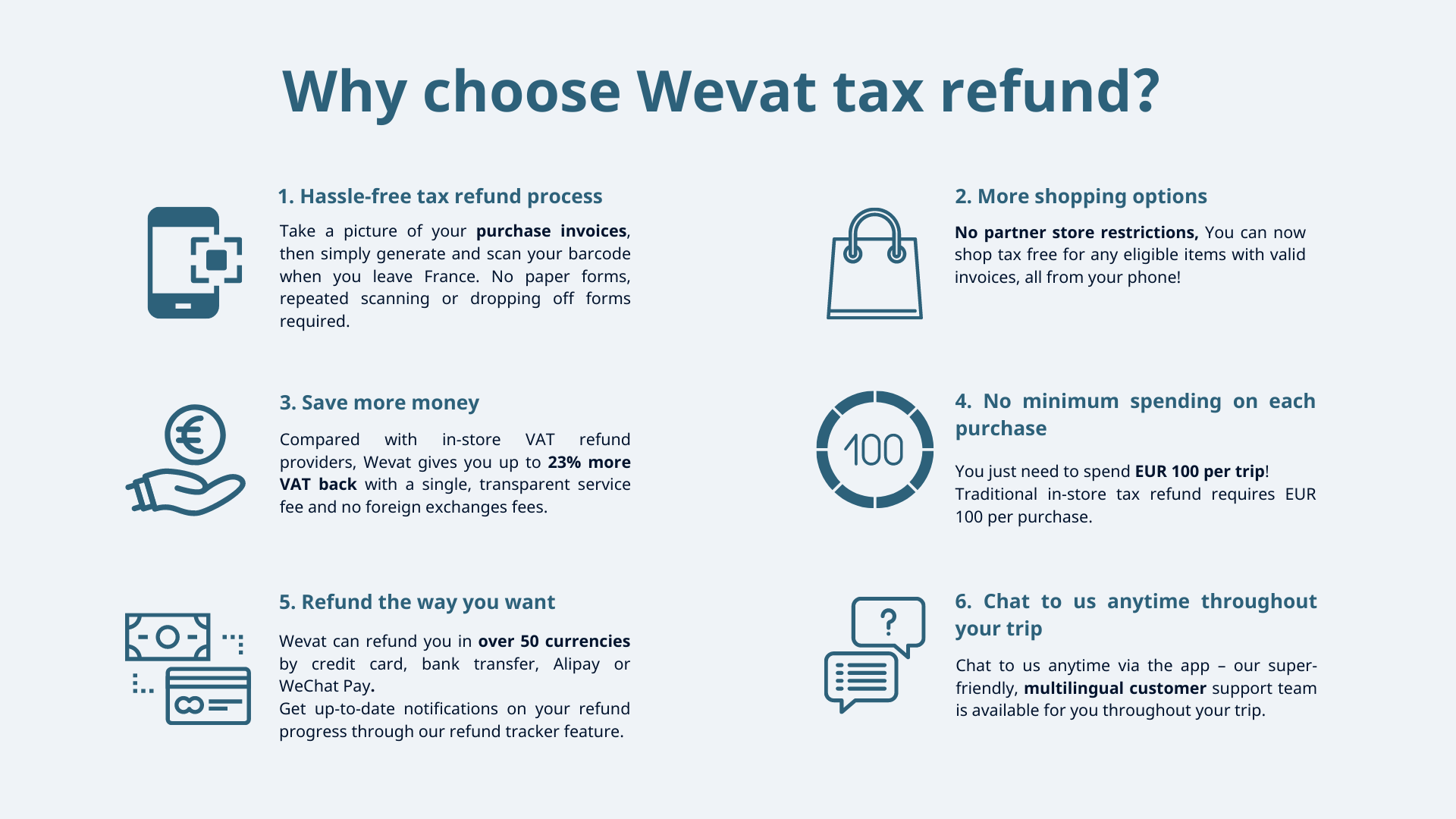

Wevat is coming to digitalize the process so you can get more money back and enjoy a hassle-free experience. Follow the 3 easy steps in the app and save 13% on your shopping.

Can I get a VAT refund when shopping at Galeries Lafayette in France?

Yes! VAT can be claimed back on most items purchased in France as long as they are for personal use and taken when you leave. Items include clothing, accessories, jewelry, technology, cosmetics, souvenirs, wine, and much more.

If using the traditional in-store tax refund method when shopping at Galeries Lafayette, you can obtain a 12% VAT refund on purchases made over €100, while Wevat offers you a 13% tax refund with less paperwork and no minimum spending requirements on each purchase. Here’s the three-step process that shows how simple saving money can be with Wevat!

How to get your VAT refund in 3 easy steps?

Download our app now to start saving money on your shopping in France!

If you have more questions about what items are eligible to get a VAT refund, and which stores I can shop at, please read our blog or pop up a question in the app, our in-chat customer support team is standing by to help you!