Why tourists can enjoy tax-free shopping in France?

In most countries, the price of goods will include value-added tax (VAT), which is automatically added to your shopping, and can be as much as 20-25% of the original price 😱.

Luckily, if you're shopping abroad and take your purchases home with you to enjoy, you're eligible for a VAT refund. Think of it as duty-free shopping at airports, except now you can do it in the city in most stores too. After Brexit, British travellers can also claim a VAT refund on purchases made in France!

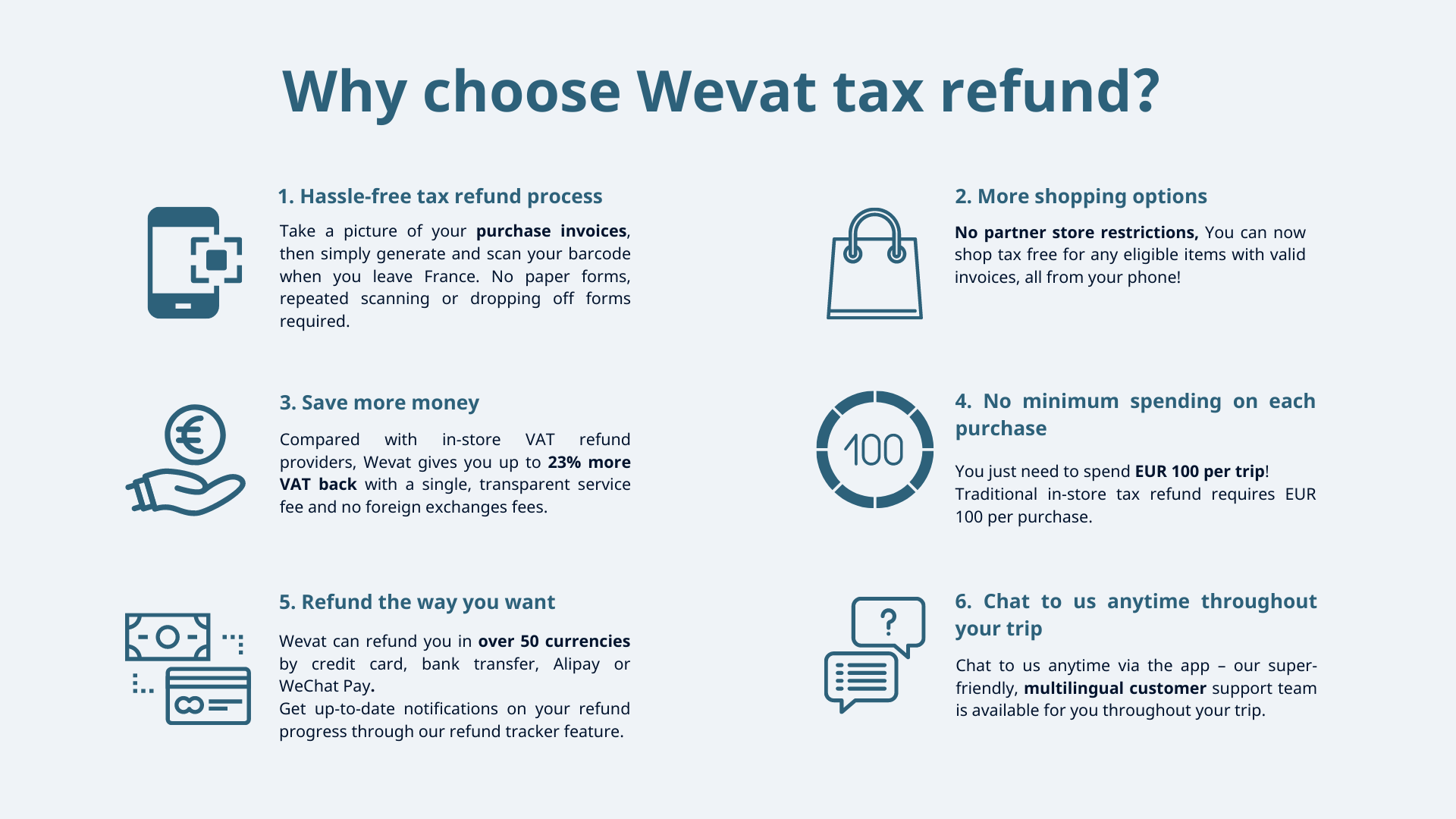

Wevat is coming to digitalize the process so you can get more money back and enjoy a hassle-free experience. Follow the 3 easy steps in the app and save 13% on your shopping.

How to get your VAT refund in 3 easy steps?

How to get tax refunds if departing from Gare du Nord Eurostar station?

After uploading the invoices and generating the digital tax refund form in the app, you can get it validated at the PABLO détaxe Tax refund self-service kiosk at Gare du Nord Eurostar station. Simply follow the on-screen instructions to scan the barcode you've generated on the Wevat app. The screen below that reads 'validated form' means it’s successful! All that's left to do is wait to receive your refund via your preferred refund method selected from the Wevat app.

That’s all there is to it! - it's as simple as that!

Download our app now to start saving money on your shopping in France!

If you have more questions about what items are eligible to get a VAT refund, and which stores I can shop at, please read our blog or pop up a question in the app. Our in-chat customer support team is standing by to help you!